Sadly, you may’t prequalify for a private bank loan with this lender, this means you’ll must comply with a tough credit Examine to discover in case you fulfill LightStream’s specifications.

Irrespective of whether you go that route or have The cash despatched for your banking account, loan funding might take only one company working day.

If you do qualify with Upstart, you may facial area a higher APR and double-digit origination rate. However, these can be worthwhile concessions if other lenders have denied your mortgage application.

We benefit your believe in. Our mission is to offer audience with exact and unbiased facts, and We've got editorial benchmarks in place making sure that happens. Our editors and reporters thoroughly simple fact-Look at editorial content material to guarantee the information you’re looking through is exact.

You’ll also need to add verifying paperwork, like fork out stubs or financial institution statements. At this point, a lender will operate a hard credit Verify, which could ding your credit score score by some factors. As long as you spend your loan back punctually, your credit rating rating ought to Get better speedily.

The cash we make aids us Offer you access to cost-free credit history scores and studies and aids us build our other excellent instruments and educational components.

At last, we evaluated Each and every provider’s buyer assist tools, borrower perks and capabilities that simplify the borrowing procedure—like prequalification solutions and cell apps.

Repayment knowledge: To begin with, we take into consideration Just about every lender’s name and business enterprise tactics. We also favor lenders that report to all key credit rating bureaus, present reputable customer care and supply any unique benefits to buyers, check here like absolutely free prosperity coaching.

At times have larger APRs. As being a general rule, the much easier it is actually to qualify for a financial loan, the higher the APR. Many banks and credit history unions supply reduced typical APRs as they only lend to existing account holders.

Existence insurance coverage doesn’t ought to be difficult. Find relief and pick the proper policy for yourself.

Existing, faithful bank prospects: Some financial institutions supply existing shoppers fascination charge discounts or maybe more versatile borrowing standards.

The appliance process for online private loans is often carried out over the internet. Borrowers can full purposes, submit paperwork, and acquire approvals electronically. Although you could be guided to an online application from a brick-and-mortar lender, you even have the option to do an in-person stop by.

If you need revenue to purchase house advancements, you may have numerous choices, together with property equity loans, HELOCs and online loans. On the list of benefits of an unsecured private loan is you don’t really need to use your house as collateral.

Examining a fee by means of us generates a tender credit score inquiry on an individual’s credit report, which is noticeable only to that man or woman. A hard credit rating inquiry, which happens to be visible to that particular person and Many others, and which may have an effect on that man or woman’s credit history rating, only seems on the person’s credit score report if and every time a loan is issued to the person.

Ariana Richards Then & Now!

Ariana Richards Then & Now! Tonya Harding Then & Now!

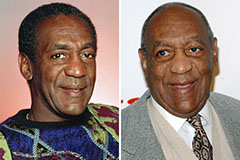

Tonya Harding Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!